Personal Income Tax Malaysia 2021 Borang

Register at the nearest IRBM Inland Revenue Board of MalaysiaLHDN Lembaga Hasil Dalam Negeri branch OR register online at hasilgovmy. What Is A Tax Exemption.

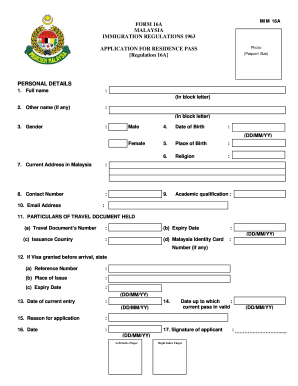

Form Imm 16a Malaysia Fill Out And Sign Printable Pdf Template Signnow

Calculations RM Rate TaxRM 0 - 5000.

Personal income tax malaysia 2021 borang. On the First 2500. A first-timers easy guide to filing taxes 2021. If you are late when submitting your tax form you will need to pay a penalty.

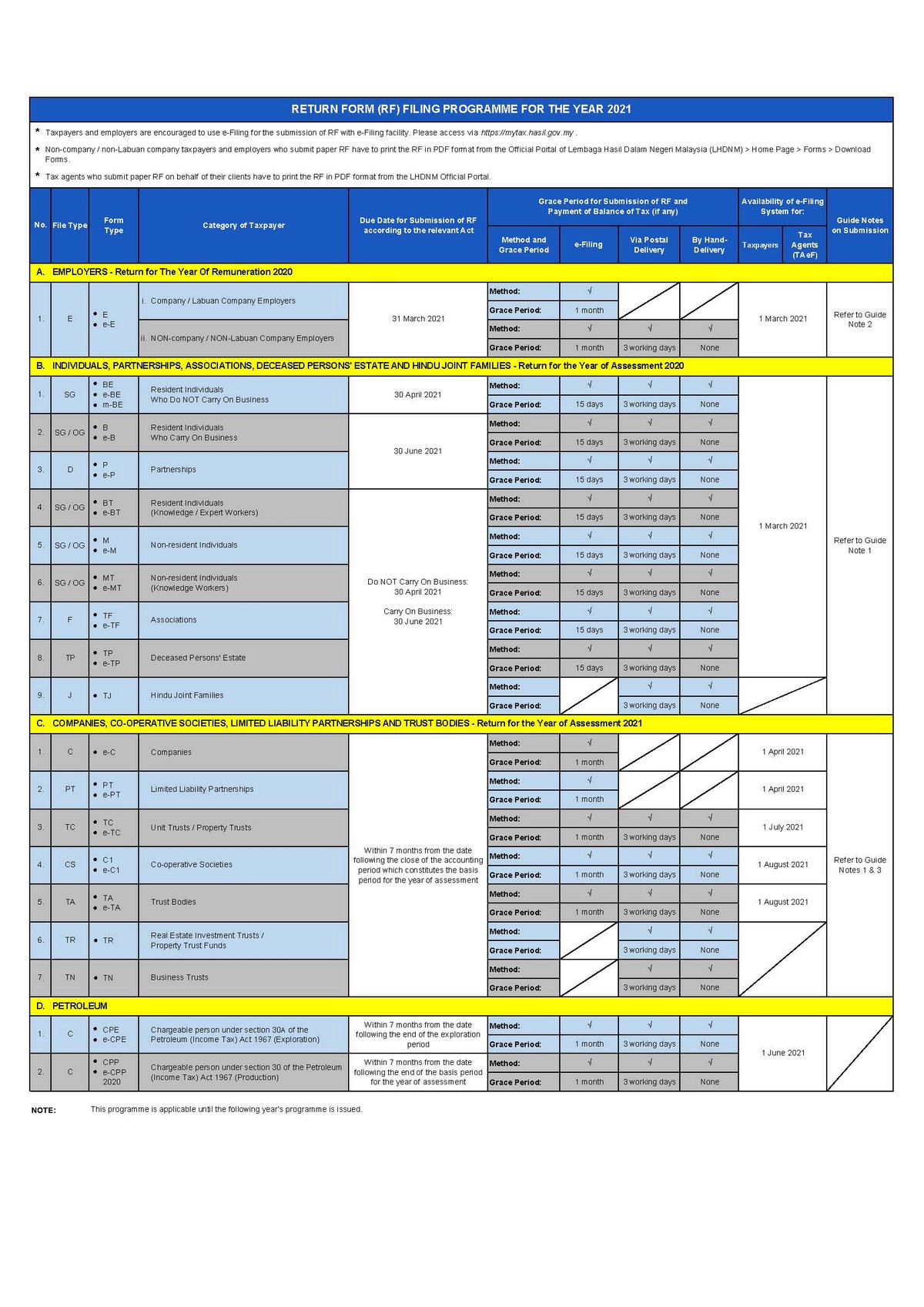

Lembaga Hasil Dalam Negeri Malaysia. Program Memfail Borang Nyata BN Bagi Tahun 2021. Individual - Taxes on personal income.

She explained Under Malaysias taxation system gratuity would be taxed under s131a while the loss of employment would be taxed under s131e of the Income Tax Act 1967. Both come with different types of tax exemption. Meanwhile for the B form resident individuals who carry on business the deadline is.

What Is Chargeable Income. Malaysia Personal Income Tax Guide For 2021. Program Memfail Borang Nyata BN Bagi Tahun 2021.

Any individual earning a minimum of RM34000 after EPF deductions must register a tax file. 1 - 4 Fill in relevant information only. An individual whether tax resident or non-resident in Malaysia is taxed on any income accruing in or derived from Malaysia.

This will give you unnecessary costs that could have easily been avoided. Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di. OG 5 Passport no.

Income Tax Act 1967 Production Within 7 months from the date following the end of the basis period for the year of assessment D. Lembaga Hasil Dalam Negeri MalaysiaInland Revenue Board Of Malaysia. Program Memfail Borang Nyata BN Bagi Tahun 2021 Pindaan 12021 Program Memfail Borang Nyata BN Bagi Tahun 2021 Pindaan 22021.

The Act was last revised in 2013. Pengiraan RM Kadar. Program Memfail Borang Nyata BN Bagi Tahun 2021 Pindaan 12021.

If you are newly taxable you must register an income tax reference number. What Is Tax Rebate. You will have to pay more.

According to Malaysia Budget 2021 income tax exemption limit for compensation for loss of employment will increase from RM10000 to RM20000 for each full year of service applicable for YA years of assessment in 2020 and 2021. On the First 5000 Next 15000. Cukai RM 0 - 5000.

How to File Income Tax in Malaysia 2021 LHDNAre you filing your income tax for the first time. OG 10234567080 Income tax no. Tax Relief For Year Of Assessment 2020 Tax Filed In 2021 Chapter 5.

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Tax Administration Diagnostic Assessment ToolTADAT. Pembayar cukai dinasihatkan untuk menggunakan pengesahan penerimaan borang nyata cukai pendapatan sebagai pengesahan status seseorang yang dikenakan cukai di Malaysia.

This translates to roughly RM2833 per month after EPF deductions or about RM3000 net. The penalty will be imposed if there is a delay in the submission of your Income Tax Return Form. For the item Income tax no enter SG or OG followed by the income tax number in the box provided.

Annual income statement prepared by company to employees for tax submission purpose. C CPE e-CPE Chargeable person under section 30A of the Petroleum Income Tax Act 1967 Exploration Within 7 months from the date following the end of the exploration period 1 June 2021 TN. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2020 for manual filing and 15 May 2020 via e-Filing.

Tax Administration Diagnostic Assessment ToolTADAT Association of Tax Authorities in Islamic CountriesATAIC. Deadline for Malaysia Income Tax Submission in 2021 for 2020 calendar year Posted February 19 2021 August 6 2021 admin. It should be noted that this takes into account all your income.

For Income tax no. Tax Rates For Year Of Assessment 2020 Tax Filed In 2021 Chapter 6. Malaysia Income Tax e-Filing Guide For Newbies.

Last reviewed - 21 July 2021. What Is A Tax Deduction. You must be wondering how to start filing income tax for the.

Lembaga Hasil Dalam Negeri. Registered with LHDNM Enter the last passport number filed with LHDNM prior to the current passport. Who needs to file income tax.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8.

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

Comments

Post a Comment