How To Fill Borang E Submission Company

The following information are required to fill up the Form E. Please be reminded to check the forms as it is the employers responsibility to provide accurate information to the statutory bodies.

Borang Imm 55 Pdf 2020 2021 Fill And Sign Printable Template Online Us Legal Forms

You can try to call to ask if not then go there and ask.

How to fill borang e submission company. To use e-filing for the first time you need to get PIN number first. Select e-Borang under e-Filing. Send email to pinhasilgovmy and please attach copy of identity card front and back or passport.

A minimum fine of RM200 will be imposed by IRB for failure to prepare and submit the Form E to IRB as well as prepare and deliver Form EA to the employees. Head over to Payroll Payroll Settings Form E. Go to the Nearest IRBM branch.

EzHASiL System will display screen as below. Select applicable form type and Year of Assessment. The e-filing steps will be enclosed together with the PIN number.

This will save time and simplify the users process. You are advised to keep and remember your e-filing. Enter the PIN and your IC number to proceed with registering a digital certificate.

Within a period of 60 days from the due date for submission of ITRF the amount of increase in tax charged shall be 10 of the amount of such tax payable or additional tax payable. When the employee fill in the e-BE e-B e-BT e-M e-MT the salary income information will automatically appear on the e-Form. Every company needs to submit Form E according to the Income Tax Act 1967 Akta 53.

Go to e-Hasils First Time Login. You will also need to supply a password. Or Company Registration Number then click Proceed.

The taxpayer is required to fill in the column for increase in tax in the ARF. Login to the PayrollPanda app go to Yearly Forms Select Form E Download the CP8D txt file and form E pdf file. The good news is you can apply for free 60 days QNE Payroll license.

IRB has taken action against 65392 company and non-company employers for not submitting the Form E for Year of Assessment 2014. Once that is done click on Download Form E sign and submit via E-Filing. Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March.

Click on e-Form link under e-Filing menu. Click Create Form E for 2021. Fill in your name IC number tax reference number etc.

With Talenox Payroll you can submit Borang E in just 3 steps. In addition every employer shall for each calendar year prepare and render to. Click on Generate Form E for 2020.

Every employer shall for each year furnish to the Director General a. Login to the LHDN Portal via. The following information are required to fill up the Borang E.

The Prefill data is the employee income data and the data will be included in the employee e-Form. Form E Borang E is a form required to be fill and submit to Inland Revenue Board of Malaysia IBRM by an employer. I went there they wanted me to write an official letter to raise the issue and request to reset the e-borang.

Please ensure that you have turn off the pop-up blocker function on your internet browser. Important things to take note about filing Form E. These employers failing to submit a Form E are liable to a fine of not less than RM 200 and not more than RM 20000 or to imprisonment for a term not exceeding 6 months or to both under the Income Tax Act Section.

If the amended Return Form is furnish. Submit form E to LHDN via e-filing. You can do so by.

Anda sudah menerima penyata EA tetapi masih keliru untuk isi e-Filing. Wuahahahhahahaha my rookie mistake last time. Or better just prepare official letter to reset ur e-borang.

Details for ALL employees remuneration matters to be included in the CP8D. In this example 2019. Basically its a form of declaration report to inform the IRB on the number of employees and the list of employees income details and must be submitted by 31st March of each calendar year.

How do I submit the Form B through e-filing. Once you have done this step click on Download Form E sign and submit E filling 2021. Mari tonton video ini.

Failure in submitting Borang E will result in the IRB taking legal action against the companys directors. Select the Year Assessment you will be filing for. Salaries wages allowance incentives etc to be included in the CP8D form.

Individuals should click on Pendaftaran Individu and companies should click on Pendaftaran Syarikat Fill in the online registration form with complete details. But donno now got change or not. Upload your completed application form and reconfirm the application.

Go to Payroll Payroll Settings Form E. Go to the e-Daftar registration page and click on Borang Pendapatan Online. Cross-check all E forms information to make sure everything is in order and written correctly.

E-Form e-BE screen will be displayed in a new window. Select form type e-E and input your Income Tax No. Double-check each employees Borang E to ensure that everything is in place.

Information available in the form is.

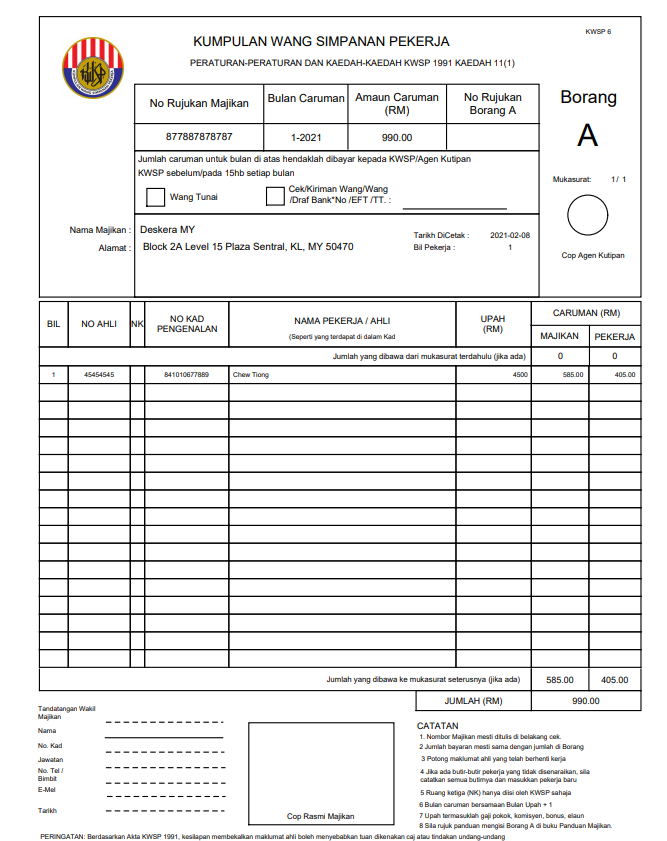

How To Generate Kwsp Borang A Form Txt Csv File Using Deskera People

Comments

Post a Comment