How To Fill Borang P In Efilling

Choose your corresponding income tax form ie. EzHASiL System will display screen as below.

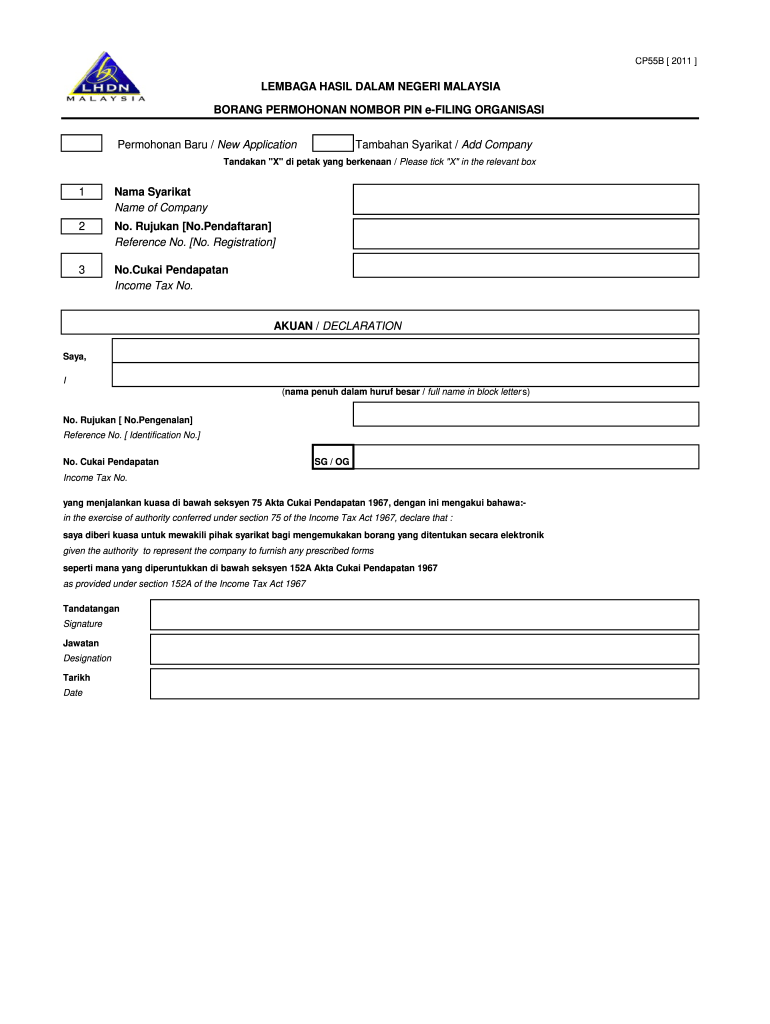

Cp55d Fill Online Printable Fillable Blank Pdffiller

Please ensure that you have turn off the pop-up blocker function on your internet browser.

How to fill borang p in efilling. You fill up Borang BE. E-BE if you dont have business income and choose the assessment year tahun taksiran 2015. Select applicable form type and Year of Assessment.

Sistem ezHASiL akan memaparkan skrin e-Borang seperti di bawah. Cara Isi Borang e-Filing Online. Send email to pinhasilgovmy and please attach copy of identity card front and back or passport.

Borang P hendaklah ditandatangani oleh ahli kongsi utama perkongsian dengan menggunakan kata laluan e-filing individu ahli kongsi utama tersebut. This method of e-filing is becoming popular among taxpayers for its simplicity and user-friendliness. Fill in the date of filing the Petition Borang 1.

Other than e-Data Praisi and e-Filing e-E CP8D must be submitted in Excel or txt file format by sending an e-mail to CP8Dhasilgovmy. 4 Easy Steps of e-Filing. Tidak kira kali pertama isi atau sudah berkali-kali.

Click on e-Form link under e-Filing menu. How to generate CP8D Form. Browse to ezHASiL e-Filing website and click First Time Login.

Cara isi e-Filing LHDN untuk 20202021 Panduan Lengkap Panduan lengkap cara isi borang eFiling e-Filing LHDN langkah demi langkah. Lembaga Hasil Dalam Negeri. Once youve logged in under the e-filing section click on e-Borang and that will take you to your tax e-filing form.

Panduan Pengguna e-Borang ezHASiL versi 32 Panduan Pengguna e-Borang ezHASiL versi 32 6 12 e-Borang Pengguna akan dipaparkan skrin Perkhidmatan apabila telah berjaya log masuk sistem ezHASiL. With Talenox Payroll you can submit Borang E in just 3 steps. Dan anda perlukan sedikit rujukan agar proses tersebut berjalan lancar.

You fill up Borang B. Klik pada pautan e-Borang di bawah menu e-Filing. How do I submit the Form B through e-filing.

Complete the return correctly 13 Sign the return digitally and submit SuccessfulSuccessful-- Acknowledgement Acknowledgement receipt Print or Save. 4 main steps to do e-Filing by the Inland Revenue Board LHDN. Click on Generate Form E for 2020.

Then proceed to efile them under kes sedia. Savemoneymy 30 June 2013 for individuals with business source. Double-check each employees Borang E to ensure that everything is in place.

You just need to. It also saves a lot of time and very easy to complete it online rather than conventional methods by manually filling up the form because all the calculation is automatic. Fill in your firms name at the bottom of page 2.

Go to the Nearest IRBM branch. You can do so by. Write your name on below the AFIDAVIT on page 2 of Borang 1.

Remember to efile all 3 files B345. Information available in the form is. Fill in your Borang 34 and 5 according to the tutorial forms.

NOTAPendapatan Berkanun bagi Syarikat Enterprise bermaksudPendapatan Perniagaan UntungRugi Bersih GajiElaun Pemilik-----. Setelah berjaya log masuk ke sistem ezHASiL skrin Perkhidmatan akan dipaparkan. You fill up Borang P.

Fill up PIN Number and MyKad Number click Submit button. Review all the information click Agree Submit button. E-Form e-BE screen will be displayed in a new window.

Now before efiling repeat the steps before. Alamat penyampaian Pempetisyen adalah di Tetuan Lee Ong Kandiah D2-3-1 Block D Solaris Dutamas No1 Jalan Dutamas 1 50480 Kuala Lumpur. Once that is done click on Download Form E sign and submit via E-Filing.

Kaedah mengisi dan menghantar Borang Nyata Cukai Pendapatan BNCP Secara elektronik melalui internet untuk. Anda mahu isi borang eFiling secara online di laman web LHDN ezHasil. Employers with their own computerised system can prepare CP8D data in the form of txt as per format specified.

EzHASil e-Filing is a most convenient way to submit Income Tax Return Form ITRF. Klik pautan e-Borang di bawah menu e-Filing. Savemoneymy 3o June 2013 for partnership.

Unlike the traditional income tax filing where you have to print out the income tax form and fill it in manually the e-Filing income tax form calculates your income tax for you automatically. Head over to Payroll Payroll Settings Form E. Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran.

The e-filing steps will be enclosed together with the PIN number. Remember to scroll down to Borang 3 to upload your Borang 3 and scroll down to Borang 4 to upload your Borang 4 and scroll down to Borang 5 to upload Borang 5. Get your PIN No.

Once you do this your e-Filing account digital certificate will be registered may proceed to complete the ITRF through ezHASiL e-Filing. And register it for Digital Certificate Login Online Form eLogin Online Form e--Form. Siapakah yang perlu menghantar Borang P sekiranya perkongsian memilih untuk menghantar Borang P melalui e-filing.

To use e-filing for the first time you need to get PIN number first. Pilih jenis borang pada skrin e-Borang dan klik tahun taksiran yang berkaitan. Sistem ezHASiL akan memaparkan skrin eBorang seperti di bawah.

Borang Dda Fill Online Printable Fillable Blank Pdffiller

Comments

Post a Comment