Lhdn Form Be Due Date

Where an employee chargeable to tax in respect of the income from an employment is about to leave or intending to leave Malaysia for a period exceeding 3 months the employer is required to furnish Form CP21 not less than 30 days before the expected date of. Form used by company to declare employees status and their salary details to LHDN 𝐃𝐞𝐚𝐝𝐥𝐢𝐧𝐞.

Irb Lhdn Latest Faqs On Tax Roundtable Consultancy Facebook

The deadline for submitting Form E is March 31.

Lhdn form be due date. Please press to obtain the e-form year of assessment 2013. Please click here to enter Customer Feedback Form. Meanwhile for the B form resident individuals who carry on business the deadline is 15 July for e-Filing and 30 June.

Lhdn E Filing 2020 Due Date The due date for submission of the reits rf form tr for year of assessment 2020 is 31 december 2020. According to Lembaga Hasil Dalam Negeri LHDN the move is meant to facilitate the submission of tax returns affected by the national movement control order which starts today. Thus the new deadline for filing your income tax returns in Malaysia via e-Filing is 30 June 2020 for resident individuals who do not carry on a business and 30 August 2020 for resident individuals who carry on a business.

Untuk makluman pengemukaan Borang Nyata Cukai Pendapatan BNCP Lembaga Hasil Dalam Negeri Malaysia LHDNM untuk tahun taksiran 2020 melalui e-filling bagi borang E BE B BT P MT dan TF boleh dilakukan pada tarikh yang dinyatakan. Tarikh Akhir e-Filling 2021 LHDNPerhatian buat pembayar cukaiBila tarikh akhir hantar borang cukai efilling 2021 untuk tahun taksiran 2020. Workers or employers can report their income in 2020 from March 1 2021.

31032021 30042021 for e-filing. E-Filing is not available for Form TJ. E-Filing is not available for Form TJ.

Form to be received by IRB within 3 working days after the due date. E filing borang e due date. Action under subsection 1201 ITA 1967.

The Malaysian Inland Revenue Department LHDN officially announced the 2021 income tax filing deadline. Please attached you identification document during submission. Due date.

Forms BE BT M MT TF TJ and TP for YA 2020 for taxpayers not carrying on a business. 2 Failure to furnish a return on or before the due date for submission. Leaving Malaysia for more than 3 months.

The due date for submission of Form BE for Year of Assessment 2019 is 30 April 2020. If Lembaga Hasil Dalam Negeri Malaysia LHDNM received the RF via postal delivery on 6 January 2022 the. 03-8911 1000 Dalam Negara 603-8911 1100 Luar Negara.

For OeF PIN Number application company must use CP55B form. The links are as followsOffices Revenue Service Centres Urban Transformation Centres UTC. - Penalty under subsection 1123 of the Income Tax Act 1967 ITA 1967 shall be imposed.

Form Type Taxpayer Year of Assessment Deadline Extended Deadline by e-Filing A. Grace period is given until 15 May 2020 for the e-Filing of Form BE Form e-BE for Year of Assessment 2019. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing.

Employers Form E Employers YA 2019 31 March 2020 31 May 2020 B. LHDN extends deadlines for submission of tax return forms KUALA LUMPUR June 29 Bernama -- The Inland Revenue Board IRB has extended the deadlines for submission of Tax Return Form for several categories of taxpayers following the extension of the Phase One of Movement Control under the National Recovery Plan. The due date for submission of the REITs RF Form TR for Year of Assessment 2021 is 31 December 2021.

11 Paying income tax due accordingly may avoiding you from being charged tax increase court action and also stoppage from leaving Malaysia. The deadline for filing income tax return forms in Malaysia has been extended by two months. Grace period is given until 5 January 2022.

For individual e-filing PIN application via e-mail can be made using Customer Feedback Form. 30th June 2021 is the final date for submission of Form B Year Assessment 2020 and the payment of income tax for individuals who earn business income. Individuals Partnerships Form BE Resident Individuals Who Do Not Carry on Business YA 2019 30 April 2020 30 June 2020 Form B Resident Individuals Who Carry on Business YA 2019 F 30 June 2020.

B Via postal delivery. Frequently Asked Questions On Taxation Matters During the The usage of the Digital Franking System DFS 20 will effectively Movement Control Order PKP 30 has been uploaded to the end on the 30th June 2021 at all Branch Stamp Offices Satellite Official Portal of the IRBM. Within 15 days after the due date.

Due date to furnish this form and pay the balance of tax payable30 April 2019.

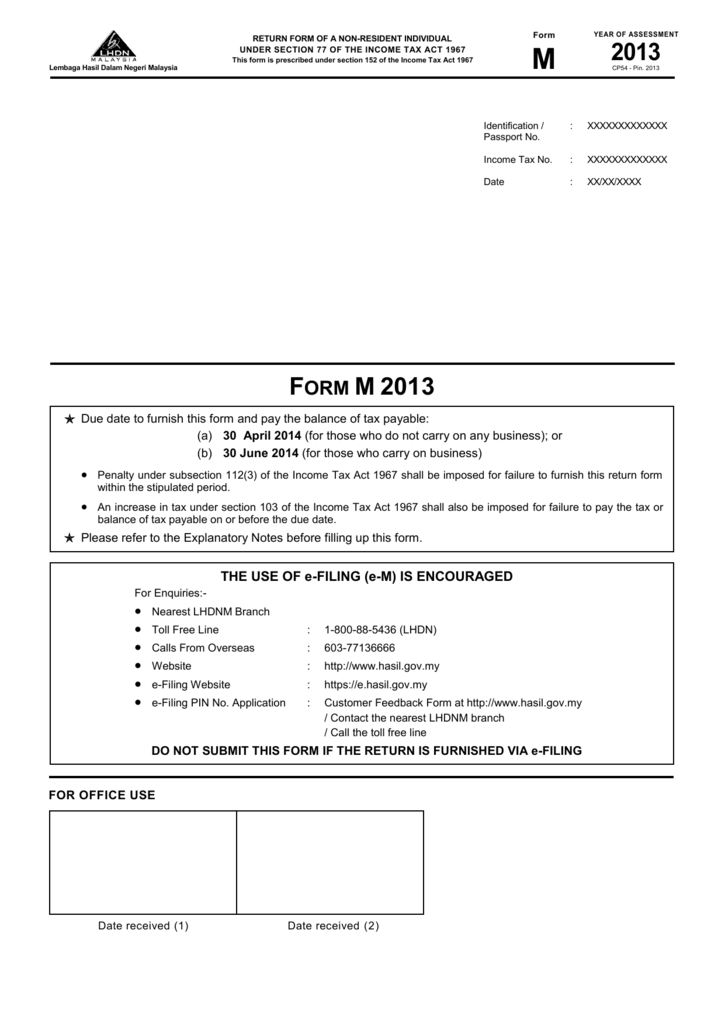

Form M 2013 2013 Lembaga Hasil Dalam Negeri

Comments

Post a Comment