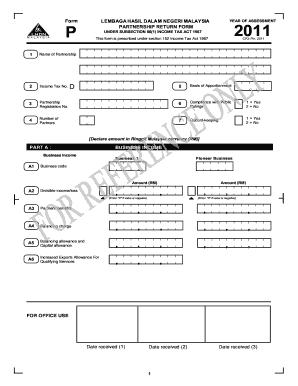

How To Change Ldhn Borang P

Google Chrome Go to Settings - Privacy - Contents settings - Pop-ups. Select the Year Assessment you will be filing for.

Borang Pendaftaran Perkahwinan Jpn Kc 06 Pdf Forms Portal In 2021 Form Portal Registration Form

Lick on lock pop-up windows checkbox to remove.

How to change ldhn borang p. In this example 2019. Please complete all relevant items in block letters in the boxes provided and use black ink pen. Resident Who Does Not Carry On Business.

Or better just prepare official letter to reset ur e-borang. Mozilla Firefox Go to Menu - Options - Content - Pop ups. Lick on button to change display to OFF.

Fill in your company details and select MUAT NAIK CP8D in. Dan anda perlukan sedikit rujukan agar proses tersebut berjalan lancar. Employers who have submitted information via e-Data Praisi need not complete and furnish CP8D.

All the documents must be certified by the company secretary. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian. Panduan Pengguna e-Borang ezHASiL versi 32 Panduan Pengguna e-Borang ezHASiL versi 32 11 a.

Click on button to change display to OFF. LHDNM has to be notified in writing in case of any amendment to the Form P already submitted. Click on Block pop-up windows checkbox to remove.

Or Company Registration Number then click Proceed. So the net remuneration. Lembaga Hasil Dalam Negeri LHDN Inland Revenue Board IRB who.

Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran. Perniagaan Bekerja Sendiri Perkongsian 03-8911 1300. Mozilla Firefox Go to Menu - Options - Content - Pop ups.

Wuahahahhahahaha my rookie mistake last time. You can try to call to ask if not then go there and ask. Bagi pengisian Borang P tuan boleh berpandukan kepada helaian kerja HK-1A Buku Panduan Borang P sebagai garis panduan.

Form E will only be considered complete if CP8D is submitted on or before the due date for submission of the form. B A B x 5 where. Cara isi e-Filing LHDN untuk 20202021 Panduan Lengkap Panduan lengkap cara isi borang eFiling e-Filing LHDN langkah demi langkah.

Tandatangan Hantar - Untuk menghantar e-Borang c. Resident who Carry On Business. But donno now got change or not.

Select e-Borang under e-Filing. Next click the sign and submit button enter your identification number and password in the pop-up and press the sign button. Penentuan sama ada pengiraan tuan akan diterima atau tidak akan diketahui apabila perkongsian tuan diaudit oleh pegawai LHDNM.

Two copies 2 Form 13 - Change of company name if relevant Two copies2 Form 49 - Name and the address of the directors. Cetak Draf Borang Mencetak draf borang dalam bentuk PDF b. After the period of 60 days but not later than 6 months from the due date for submission of ITRF the amount of increase in tax charged shall be determined in accordance with the following formula.

BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut. Application form to register an income tax reference number can be obtained from the nearest IRBM counter. Google Chrome Go to Settings - Privacy - Contents settings - Pop-ups.

Two copies 2 Form 24 - List of the shareholders. Employers are encouraged to furnish CP8D via e-Filing if Form E is submitted via e-Filing. Finally youre done with filing your income taxes for YA 2019.

According to category under the MTD Schedule. Suruhanjaya Syarikat Malaysia SSM Companies Commission of Malaysia CCM where you register your LLP get its birth certificate and do your annual declarations. I went there they wanted me to write an official letter to raise the issue and request to reset the e-borang.

Please ensure that you have registered your Digital Certificate If not please click here. Select form type e-E and input your Income Tax No. An employee receives a monthly remuneration amounting to RM4000 EPF deduction.

Bantuan Khas Kerajaan. B 10 of the amount of such tax payable or. On the declaration page request a TAC from the number youve registered with LHDN and key it in.

The precedent partner is responsible for issuing the Form CP30 Amendment to each partner if there is any change in the distribution of partnership income. Sekiranya tuanpuan mengalami masalah menghubungi Hasil Care Line tuanpuan juga boleh menghubungi mana-mana Cawangan LHDNM terdekat untuk mendapatkan bantuan. Hey There GuysNeed your suggestions regarding the LHDN Borang TP3I just go a job with Company B.

A the amount of such tax payable or additional tax payable. Adakah pengiraan saya akan diterima. When I was with Company A I only had PCB deduction twice a year bonus month as my salary was low.

Joseph February 28 2021. The following example can be a guide to determine the value of MTD to be deducted from an employee. Kembali Kembali ke skrin yang sebelumnya Tekan butang Tandatangan Hantar untuk menghantar e-Borang.

Now when Company B asked me I actually edited my payslip and stated as if it was high so that i could get a. I have received this TP3 form from them requesting me to fill up. Anda mahu isi borang eFiling secara online di laman web LHDN ezHasil.

How To Do E Filling For Lhdn Malaysia Income Tax Md

Comments

Post a Comment