How To Submit Company Borang E

Tindakan yang perlu diambil adalah seperti berikut. Even a dormant company must submit Form E.

How To Use Lhdn E Filing Platform To File Borang E To Lhdn Clpc Group

Details for ALL employees remuneration matters to be included in the CP8D.

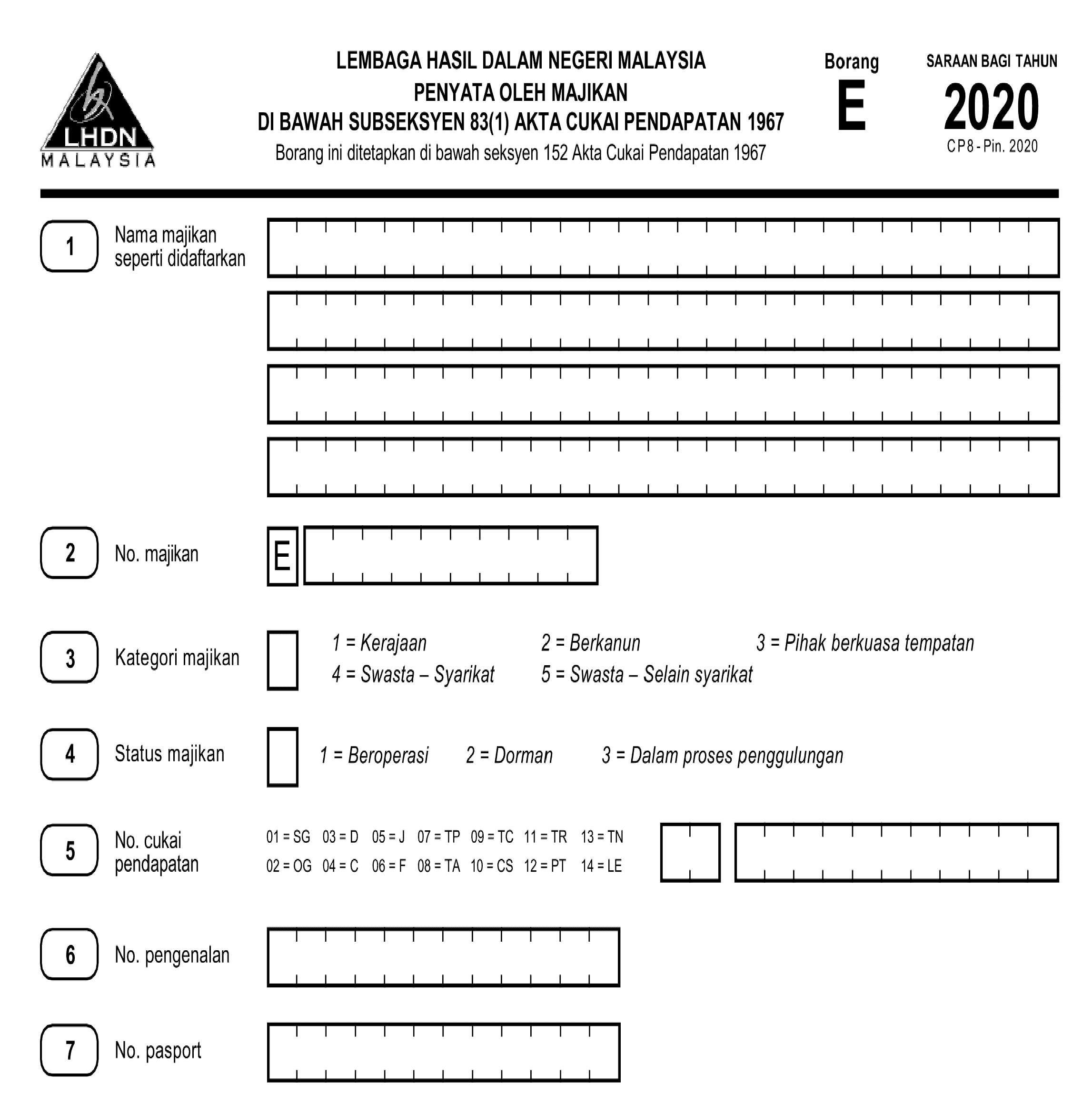

How to submit company borang e. The following information are required to fill up the Borang E. Basically its a form of declaration report to inform the IRB on the number of employees and the list of employees income details and must be submitted by 31st March of each calendar year. Apakah tindakan yang perlu diambil sekiranya Syarikat tidak beroperasi Do rmant tetapi telah menerima Borang E.

Every company needs to submit Form E according to the Income Tax Act 1967 Akta 53. For Companies LLP Trust Bodies and Co-operative Societies It is mandatory to file even the entity has no employee OR dormant OR has not commenced business during the said calendar year. Or Company Registration Number then click Proceed.

Borang e is an employers annual return of remuneration for every calendar year and due for a minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e to irb as. ðBorang E yang diterima itu perlu dilengkapkan dan ditandatangani. Large group of companies with many subsidiaries as soon as these businesses are employers must submit form E.

Form E Borang E is a form that an employer must complete and submit to the Internal Revenue Board of Malaysia IBRM or Lembaga Hasil Dalam Negeri LHDN. Borang E is an Employers annual Return of Remuneration for every calendar year and due for submission by 31st March of the following calendar year. EFilling does all the calculation automatically and this year I noticed that it even has a record of the PCB deductions figure and enter it for me automatically.

Borang nyata individu pemastautin yang tidak menjalankan perniagaan tarikh akhir. Every company needs to submit form e according to the income tax act 1967 akta 53.

Form e borang e is a form required to be fill and submit to inland revenue board of malaysia ibrm by an employer. Upon selecting MUAT NAIK CP8D click Choose File to attach your HReasily TXT FILE and select MUAT NAIK to upload. Cukai Pendapatan SG OG Income Tax No.

For companies form E submission can only be done online. Overtime Calculator for Payroll Malaysia - Payroll Process 1. Microsoft Windows 81 service pack terkini Linux atau Macintosh.

Every employer shall for each year furnish to the Director General a return in the prescribed form. Select form type e-E and input your Income Tax No. Selangor pupils need to submit their borang 1 2 by then for every pupils remember to extract your borang 3 when it is ready for extraction.

Sole proprietor partnership a private limited company or a. Malaysia Epf Calculator For Payroll System - Payroll Process 2. Permohonan Baru New Application Tambahan Syarikat Add Company 1 Nama Syarikat Name of Company 2 No.

Menghantar Borang E untuk mengelakkan borang tersebut lambat diproses. We would like to show you a description here but the site wont allow us. Internet Explorer 110 Microsoft Edge Mozilla Firefox 440 Google Chrome 460 atau Safari 5.

According to the Inland Revenue Board of Malaysia LHDN a business which earn business income whether it is a. Generate Form E and CP8D txt file via the PayrollPanda app. STEP 6- 如果您没用payroll软件 请选择 Bersama Borang E submit together with E Form.

Salary Calculator Malaysia for Payroll System - Payroll Process 3. Get the latest business insights from Dun Bradstreet. Product - Access Control System - - Door Access.

Payslip Template for Payroll Malaysia. How to submit Form E via e-Filing. Press Continue or teruskan.

AKUAN DECLARATION Saya I No. Every employer shall for each year furnish to the Director General a. Form E Borang E is a form required to be fill and submit to Inland Revenue Board of Malaysia IBRM by an employer.

- Payroll Process 5. Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM. Fill in your company details and select MUAT NAIK CP8D in the dropdown.

Rujukan NoPengenalan Reference No. If you have an employee during last year it is mandatory to submit Form E Borang E to LHDN Inland Revenue Board IRB by upcoming 31 March. Form e borang e is required to be submitted by every employer.

Find company research competitor information contact details financial data for Built To Submit Enterprises Inc. Rujukan NoPendaftaran Reference No. Non-companies still have the option to submit via postal or hand delivery in addition to e-filing.

Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March. Identification No No. Registration 3 NoCukai Pendapatan Income Tax No.

I usually print a hard copy of the BE form and fill it out make sure all calculations are correct then only proceed to do the eFilling. According to the Income Tax Act 1967 Akta 53. Basically it is a tax return form informing the IRB LHDN of the list of employee income information and number of employees it must be submitted by March 31 of each year.

Submit Income Tax 2019 in e-Filing - Payroll Process 4.

Comments

Post a Comment