Borang E Submission Extension

The deadline for submitting BT M MT TP TF and TJ forms non-merchants is April 30. Resident Individuals who do not carry on businesses can submit their e-BE Year of Assessment 2020 via MyTax.

/borang-permit-pergerakan-perintah-kawalan-pergerakan-(pkp).jpeg)

Covid 19 Information U S Embassy In Malaysia

6 03 2698 8044 extensions 8982 7706 Note.

Borang e submission extension. B CP8D must be submitted via the following methods- Method of CP8D Submission i Together with Form e-E e-Filing upload txt file format CP8D e-Filing format. Form E and CP8D which do not comply with the format as stipulated. The deadline for BE is April 30.

The deadline for filing income tax return forms in Malaysia has been extended by two months. One Borang E-ready software you can consider from the list is Talenox. List of Application Forms Following are the list of.

29062021 d05 e-Buletin HASIL 9 Jun 2021 V3 BI Created Date. Online application is available from 700 am to 900 pm on Sunday to Friday and 900 am to 900 pm on Saturday. Head over to Payroll Payroll Settings Form.

Basically its a form of declaration report to inform the IRB on the number of employees and the list of employees income details and must be submitted by 31st March of each calendar year. According to Lembaga Hasil Dalam Negeri LHDN the move is meant to facilitate the submission of tax returns affected by the national movement control order which starts today. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut.

The Malaysian Inland Revenue Department LHDN officially announced the 2021 income tax filing deadline. The deadline for submitting Form E is March 31. The e-Filing system will be opened from 1st March 2021 and the submission deadline for e-BE YA 2020 is on the 30th April 2021.

I Submission of a Complete and Acceptable Form E a Form E shall only be considered complete if CP8D is furnished on or before the due date for submission of the form. A The completed paper return E must be submitted to Bahagian Pengurusan Rekod Maklumat Percukaian Jabatan Operasi Cukai. Untuk makluman pengemukaan Borang Nyata Cukai Pendapatan BNCP Lembaga Hasil Dalam Negeri Malaysia LHDNM untuk tahun taksiran 2020 melalui e-filling bagi borang E BE B BT P MT dan TF boleh dilakukan pada tarikh yang dinyatakan dibawah.

Workers or employers can report their income in 2020 from March 1 2021. Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran.

Talenox is a self-service HR SaaS that helps thousands of companies avoid penalisations and audits by accurately auto-calculating their salaries and taxes for free. Borang C and Borang R must be received by the IRB on or before August 14 2003. E-Filing For Income Tax Starts On 1 March 2021 LHDN Inland Revenue Board has recently released the Return Form RF Filing Programme For The Year 2021 on its website which listed all the file types due dates grace period and filing method for your references.

Members are informed that the Inland Revenue Board IRB has granted an extension of time to August 14 2003 for the submission of Borang C and Borang R for year of assessment 2002 in respect of companies whose accounting year ended on December 31 2002. Bagaimanakah saya ingin mengetahui BNCP yang dihantar secara e-filing telah berjaya dikemukakan. Thus the new deadline for filing your income tax returns in Malaysia via e-Filing is 30 June 2020 for resident.

Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian. Ree 3 months grace period from the due date of submission is allowed for those with accounting period ending 1 September 2019 until 31 December 2019 Two 2 months grace period from the due date of submission is allowed for those with accounting period ending 1 January 2020 until 31 March 2020 Form C Companies 31 July 2019 30 Sep 2019. B Form E and CP8D must be submitted in accordance with the format as provided by LHDNM.

Grace period is given until 30 June 2020 for the submission via e-Filing postal delivery or by hand-delivery. If a taxpayer furnished his Form e-BE for Year of Assessment 2019 on 1 July 2020 the receipt of his RF shall be considered late as from 1 May 2020 and penalty shall be imposed under subsection 1123 of ITA 1967. BNCP akan dianggap berjaya dihantar apabila paparan Pengesahan Penerimaan e-Borang bagi tahun taksiran berkenaan dipaparkan.

The deadline for Form B and P is June 30. With Talenox Payroll you can submit Borang E in just 3 steps. KUALA LUMPUR June 29 Bernama -- The Inland Revenue Board IRB has extended the deadlines for submission of Tax Return Form for several categories of taxpayers following the extension of the Phase One of Movement Control under the National Recovery Plan.

Form E Borang E is a form required to be fill and submit to Inland Revenue Board of Malaysia IBRM by an employer. Tarikh Akhir e-Filling 2021 LHDNPerhatian buat pembayar cukaiBila tarikh akhir hantar borang cukai efilling 2021 untuk tahun taksiran 2020. E-Filing st DUE DATE OF FORM SUBMISSION 31 July 2021 TAX RATE Based on the individuals tax rate for that year of assessment.

Selepas menghantar borang cukai pendapatan saya menyedari bahawa pendapatan yang dilaporkan adalah tidak tepat. 21 July 2021 New submission deadline for Form P B extended from 15 July to 31 Aug 2021.

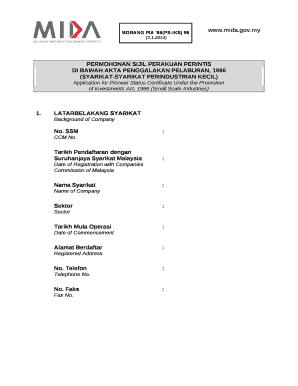

Borang Pia 86 Ps Iks 96 Doc Template Pdffiller

Comments

Post a Comment